YOUR PERSONAL CASH FLOW CONDUCTOR

Stop Playing Financial Tetris with Your Money

StashCash automatically tells you exactly when and how much to transfer between accounts—so your bills are always covered and your savings stay on track.

THE HOUSEHOLD COORDINATION PROBLEM

Two incomes, multiple accounts, one household

Modern households need financial tools that respect both partnership and independence. StashCash handles the complexity so you don't have to.

Free Cash That's Actually Free

Know what you can actually spend. StashCash tracks your "scheduled cash"—money earmarked for upcoming bills—so the number you see is truly available for daily life. No more mental math, no more accidentally spending the electric bill.

Envelope Budgeting, Automated

Use your savings account as a sophisticated envelope system. StashCash tracks balances across categories (car insurance, gifts, clothing) and ensures each envelope gets funded monthly—all while keeping bills as the top priority.

Household Bills, Individual Checking

Each partner can keep their own checking account while seamlessly funding shared bills. StashCash tracks who pays what from which account, eliminating the "did you transfer the money?" conversations and spreadsheet juggling that strain relationships.

PROACTIVE CASH FLOW

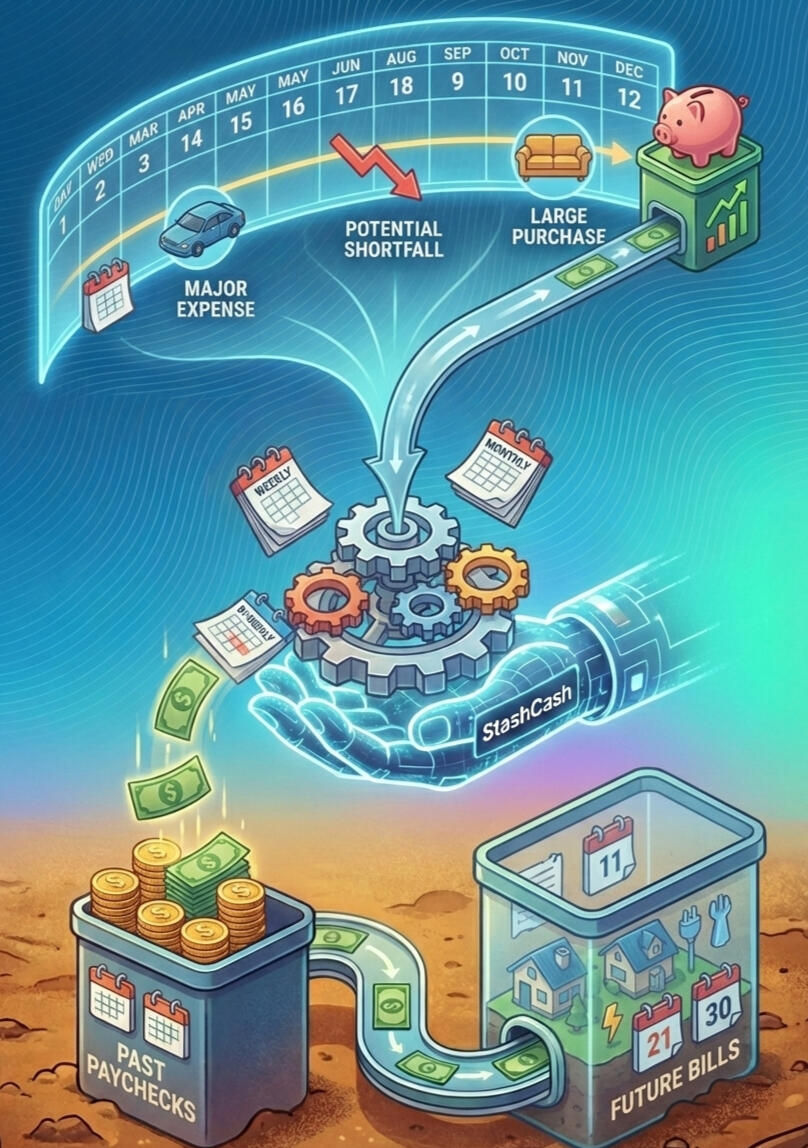

Fund tomorrow's bills with yesterday's paycheck

The secret to never feeling cash-strapped? StashCash helps you get ahead by using previous paycheck funds to cover upcoming bills—even when pay dates and due dates don't line up.

Multiple paycheck schedules, one plan

StashCash handles weekly, bi-weekly, semi-monthly, and monthly pay cycles—even when both partners are on different schedules. Our engine creates a unified cash flow plan that keeps everyone ahead of their bills.

12-month forward visibility

See your complete financial picture one year into the future. Plan for major expenses, identify potential shortfalls before they happen, and make informed decisions about large purchases with confidence.

Smart priority system

Bills get funded first, then savings allocations, then free cash buffer. Every transfer recommendation comes with a clear explanation of exactly which obligations it covers, why it's needed, and when it's needed.

SIMPLE, TRANSPARENT PRICING

Choose the plan that works for you

All features included. Cancel anytime. 34-day free trial to see if StashCash is right for your household.

MONTHLY

$15

Perfect for trying out StashCash. All features included with the flexibility to cancel anytime.

ANNUAL

$99

Get two months free when you commit to a year. Same great features, better value for households ready to transform their finances

Everything you need, nothing you don't

Both plans include unlimited bank accounts, 12-month budget, envelope budgeting, household collaboration, and priority email support.

© 2025 StashCash. All rights reserved.